Apply now with our great deals

- Action

- New UOB customers

- Existing UOB customers Existing UOB customers Existing UOB customers Existing UOB customers

| Action | New UOB customers | Existing UOB customers Existing UOB customers Existing UOB customers |

| Open a UOB One Account online | S$80 | S$40 |

| Sign up for a UOB One Card online | S$150 | S$150 |

| Total rewards | S$230 | S$230 |

| Action |

| Open a UOB One Account online |

| Sign up for a UOB One Card online |

| Total rewards |

How to earn higher interest

- Action

- First S$15,000

- 2nd S$15,000

- 3rd S$15,000

- 4th S$15,000

- 5th S$15,000

- Above S$75,000

| Action | First S$15,000 | 2nd S$15,000 | 3rd S$15,000 | 4th S$15,000 | 5th S$15,000 | Above S$75,000 |

| Card spend of min. S$500 /month |

0.25% | 0.25% | 0.25% | 0.25% | 0.25% | 0.05% |

| AND a) credit min. S$2,000 of your monthly salary, OR b) make 3 GIRO debit transactions per month |

0.75% | 0.85% | 0.90% | 1.00% | 2.50% | 0.05% |

| Action |

| Card spend of min. S$500 /month |

| AND a) credit min. S$2,000 of your monthly salary, OR b) make 3 GIRO debit transactions per month |

Important information on rates and fees

- Fee & Rate Type

- Fee & Rate Amount

| Fee & Rate Type | Fee & Rate Amount |

| Account fee | Free |

| Fall-below fee | S$5 if your average daily balance for the month falls below S$1,000 |

| Early account closure fee | S$5 if your average daily balance for the month falls below S$1,000 |

| Cheque book | S$10 per additional cheque book (50 leaves) |

| Fee & Rate Type |

| Account fee |

| Fall-below fee |

| Early account closure fee |

| Cheque book |

It’s everyday banking made a lot more rewarding.

Grow at 2.5% per year

Grow your savings at 2.5% per year. Just spend $500 monthly, and credit your salary or pay 3 bills monthly via GIRO.

10% cashback

Spend with your credit or debit card, and get up to 10% cashback on everything from groceries to shopping sprees.

One Account for All

Share the benefits with a joint account holder and manage shared finances easily.

Access up to 5 years of e-statements

Get them online and on the go via the UOB Mighty App. Good for convenience, great for the environment.

Done in 7 minutes

Opening an account takes less than 7 minutes online. Apply now at the bottom of the page.

1 Card, Everything You Need

Do it all with your UOB One Debit Mastercard. You get competitive foreign exchange rates when you spend overseas, too.

Pick your promotion

- All promotions

- Save

- Cards

- Borrow

- Invest

- Insure

Insure

InsureHome

Cover your home against the unexpected and get a 55% discount off your premiums for the 3-year plan*

Save

UOB Lady’s Savings Account

Sign up online for a new UOB Lady’s Savings Account now and get up to S$80 cash credit

Things you should know

Eligibility and required documents, Eligibility and required documents, Eligibility and required documents

Minimum Age

Annual income

- S$30,000 and above for Singaporeans and Singapore PRs

- S$45,000 and above for foreigners

Documents required

With Image

Deposit Insurance Scheme

Please refer to UOB Insured Deposit Register for a list of UOB accounts/ products that are covered under the Scheme.

With Table

- Action

- First S$15,000

- 2nd S$15,000

- 3rd S$15,000

- 4th S$15,000

- 5th S$15,000

- Above S$75,000

| Action | First S$15,000 | 2nd S$15,000 | 3rd S$15,000 | 4th S$15,000 | 5th S$15,000 | Above S$75,000 |

| Card spend of min. S$500 /month |

0.25% | 0.25% | 0.25% | 0.25% | 0.25% | 0.05% |

| AND a) credit min. S$2,000 of your monthly salary, OR b) make 3 GIRO debit transactions per month |

0.75% | 0.85% | 0.90% | 1.00% | 2.50% | 0.05% |

| Action |

| Card spend of min. S$500 /month |

| AND a) credit min. S$2,000 of your monthly salary, OR b) make 3 GIRO debit transactions per month |

Deposit Insurance Scheme

Terms & Conditions

Wouldn't it be nice if you got rewarded for saving?

New UOB customers get S$80 cash credit. Existing UOB customers get S$40 cash credit.

Trying to figure out the right account? Let's get you a little help.

Starting Out

We all have to start somewhere, right? We totally get you. We’re here to help you get started the right way.

For the Kids

It’s never too soon to be planning ahead for the little ones. Give them a head start.

New to Singapore

Planning a new beginning in Singapore? We’ll help you get set up for an exciting new chapter.

More great everyday banking accounts

Everyday

Krisflyer UOB Deposit Account

Get miles for everyday spending.

- Get up to 6 KrisFlyer miles per S$1 spend

- Easy joint account setup

- $0 monthly fees

Everyday

Uniplus Account

Earn more on your savings with bonus interest rates and up to S$100 cash credit*

- Complimentary global ATM Card or enjoy a 3-year fee waiver on your UOB Card

Everyday

Passbook Savings Account

Enjoy attractive interest rates.

- Complimentary global ATM Card or enjoy a 3-year fee waiver on your UOB Debit Card

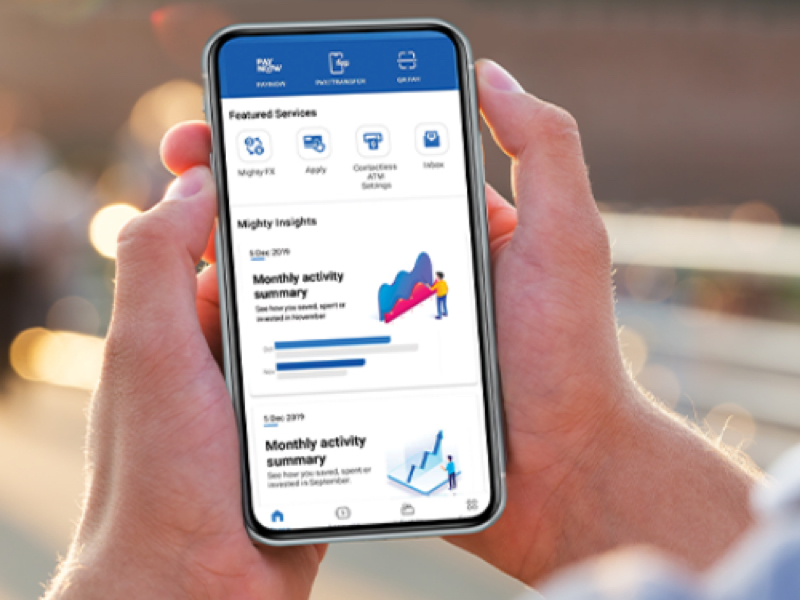

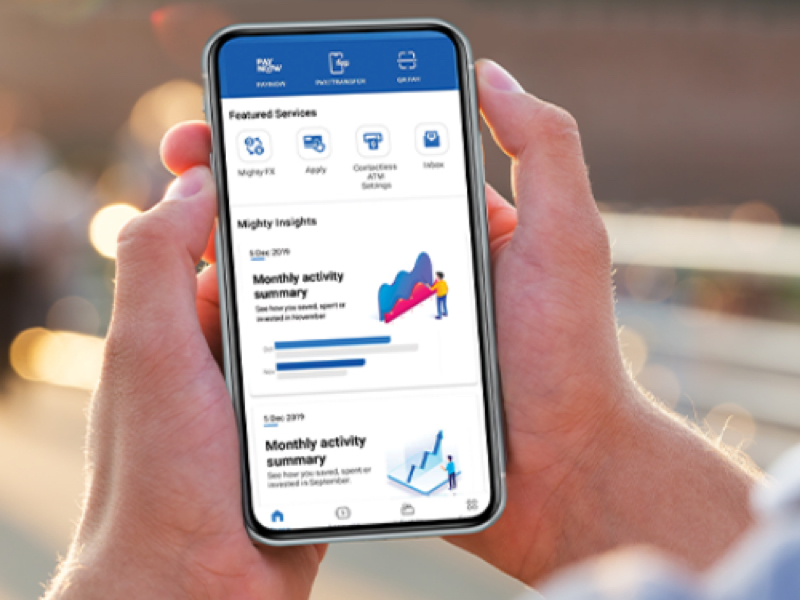

UOB Mighty App

Banking that never sleeps

Manage your accounts and transactions on the go

Make payments swiftly and securely while on the go while on the go

Exclusive deals and coupons up for grabs! Redeem your rewards anytime, anywhere.

Power your banking with Mighty Insights — personalised to your needs, habits and preferences

Life Stage Advice

You only retire once, so let's do it right, We've got some tips on choosing the right plan, and what to expect when you're ready to embark on your golden years.

See how we can help

You only retire once, so let's do it right, We've got some tips on choosing the right plan, and what to expect when you're ready to embark on your golden years.

See how we can help

You only retire once, so let's do it right, We've got some tips on choosing the right plan, and what to expect when you're ready to embark on your golden years. You only retire once, so let's do it right, We've got some tips on choosing the right plan, and what to expect when you're ready to embark on your golden years.

See how we can helpA bank beyond savings

We're here to help

Have a question?

Check our help and support centerContact Us

Ways to get in touchLocate Us

Find your nearest branch or ATMFinancial Guides

Eating well doesn't have to break the bank.

Dining deals and promotions are an excellent way of enjoying a treat or two (or three!) economically, Who knows, there might even be extra rewards in it for you.

See our latest dining offers

Retirement is really not that complicated.

The secret is finding the right plan that you can sustainably maintain that us.

Explore our retirement plans

Debt can pile up because of interest. But there's a solution.

Debt, when managed well, is a great way to maintain a comfortable lifestyle. The real challenge is keeping up with the interest rate.

See our debt consolidation plansHelpful Tips & Guides

The 5-minute guide to retirement

Everyone has to retire eventually. Planning for it should be simple.

Personal finance in a time of COVID-19

Safeguarding your personal finances is more important than ever.

Move all your banking needs to your smartphone

With the UOB Mighty App, you might never need to step into a branch again.

Need more help from us?

Contact us

Ways to get in touch.

Locate us

Find your nearest branch or ATM.